We’re all living longer. Are you ready to transition your affairs?

My father-in-law was passionate about estate planning, regularly sharing things he had read. When both of my in-laws received a diagnosis of dementia, it became clear that he had not envisioned, discussed, or planned for the scenario of becoming ill or losing mental capacity. If he, who had read so much on estate planning, had not thought about or made arrangements for such a situation, how many people would, and to what extent?

Financial oversight and caregiving support avoids undesirable consequences

Needless to say, transitioning the administration of my in-laws’ financial affairs, assisting with daily living requirements, planning a move to a retirement home with a later transition to a long-term care facility, and so much more, was very demanding for their children. My wife travelled ten hours every month to spend a week assisting her parents.

This case was probably relatively simple compared to what some other families face. My in-laws’ financial affairs were straightforward and well-organized, they had sufficient means and financial stability, they had a trustworthy financial advisor, my wife and her sibling could make time, and the overall collaboration and abilities within the family were good. That said, a few actions my father-in-law had taken when his mental abilities were starting to diminish, had poor outcomes. Undoing the consequences of these actions became an unfortunate part of the transition.

Planning for being “alive but incapable” is the new reality

There’s no escaping the reality that we’re all living longer—or perhaps, dying longer. Whether we like it or not, unless we die prematurely or very suddenly, our physical abilities will degrade, as will our mental abilities, whether it be loss of memory, loss of reasoning skills, or loss of information processing abilities. There will likely be undesirable consequences if we don’t have adequate financial oversight and caregiving support.

Planning for aging is the new reality, with the need to plan for being “alive but incapable,” over and above the states of being “alive and well” and “dead.” People think about their finances and their estates, but what happens if you can’t care for yourself or manage your own affairs is something that is often overlooked.

Power of attorneys are fundamental

A power of attorney (POA) for property and a POA for personal care are the fundamental legal documents required for proper transition of your finances and personal care when you can no longer manage these tasks and decisions. A detailed healthcare directive, a document that sets out your specific wishes for your medical care and treatments (also called a living will) is a highly desirable complement to the POA for personal care.

The key is to communicate regularly

In speaking with financial advisors, I’ve learned that when it comes to money, people hesitate to share their information, especially with their families, and find it even harder to depend on other people to make decisions for them. The same reluctance to discuss one’s affairs applies to personal care matters.

In the end, the real challenge is to set up your POA delegates (called attorney for property and attorney for care) for success and to surround yourself with advocates, including professional advisors, family, friends, and healthcare providers. The key is to communicate regularly and nurture this team of advocates, ensuring your wishes, values, and wisdom are understood and respected.

Living aging years with peace of mind

Ultimately, the mission for aging people should be to live their elderly years with peace of mind, knowing they have:

- Up-to-date financial plans that are easy to understand and transition,

- An up-to-date and activated legal foundation that includes a healthcare directive,

- An organized, simplified, downsized estate that is well documented in an estate organizer,

- A plan to seamlessly transition personal care and estate management to your designates,

- A trusted team of advocates with the best possible understanding of your wishes, and

- Regular (e.g., yearly) family meetings that include other advocates and advisors.

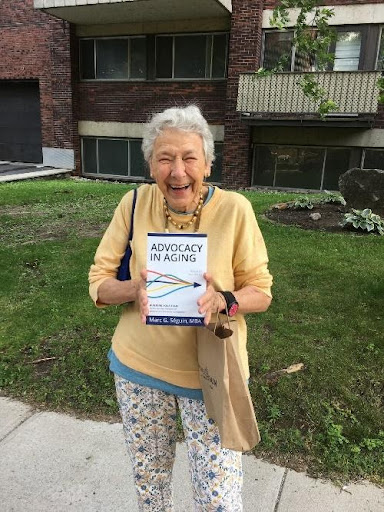

The time to build your team for the eventual transition of personal care and estate management is now. Preparing well in advance for future changes in your ability to manage your own affairs and healthcare will ensure effective advocacy for you as you age.