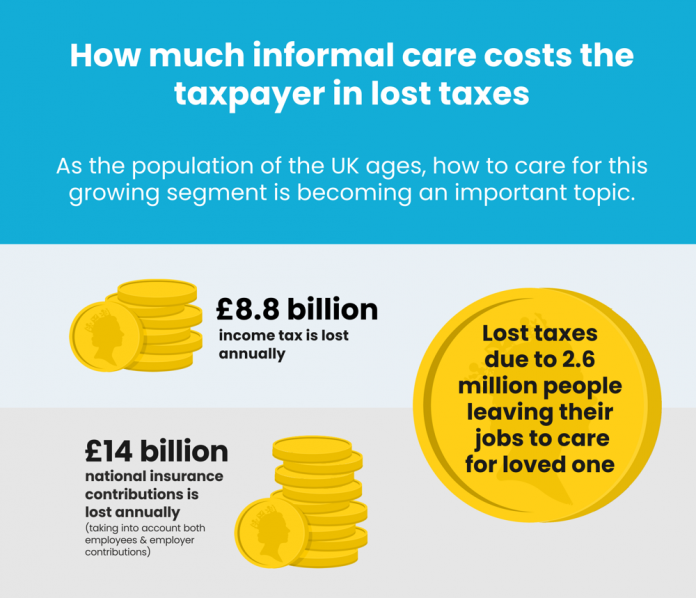

| People giving up their jobs to care for a loved one is costing the taxpayer nearly £23 billion a year in lost taxes and national insurance contributions, according to new research. |

02 August 2019

Key findings:· £14 billion is lost annually in national insurance contributions (taking into account both employees and employer contributions) from those who have stopped work to become a carer for a loved one · £8.8 billion in income tax is lost annually for the same reason

Helpd, a national agency for live-in and visiting carers, has reported that people leaving their jobs to care for loved ones is costing the public purse nearly £23 billion a year in lost income taxes and national insurance contributions based on the average national salary. According to recent figures from a You Gov and Carers UK report, 2.6 million people have left their jobs to care for loved ones. As a result, a potential £14 billion is being lost in national insurance contributions and £8.8 billion in income tax each year. In 2016/17, the UK government spent £21.2 billion[1] on adult social care, which is down 9.9% from 2009/10. As spending on adult care fell, the number of people leaving work to care for others has risen by 12%[2]. Dr Neil Parrett, the co-founder of Helpd, the home care agency that compiled the research said: “The crisis in the adult and elderly care sector means that more and more people are having to quit their jobs in order to effectively care for a loved one who is elderly, in poor health, has a disability, or those who have started to show signs of dementia or Alzheimer’s. With nearly three in five carers in England and Wales aged over 50[3], many of those people giving up their jobs are in the prime of their careers and this is having an impact on not just the individuals who are forced to leave the world of work, but also the public purse.” Dr. Parrett continues, “We need to rethink how society responds to an aging population. There is a need for flexible, affordable care, so the relatives of those who need care can continue to work. These lost taxes could go some way to help pay for better and more affordable care for the elderly and disabled. By helping to better fund home care, which is usually cheaper than using care homes, the government can help not only those who are forced to leave their job, but also help to combat loneliness and isolation for those receiving the care and help them to keep as much independence as possible. This all leads to a healthier care environment where society benefits overall. “ [1] Securing the future: funding health and social care to the 2030s, Institute of Fiscal Studies & The Health foundation, Edited by Anita Charlesworth & Paul Johnson, May 2018. [2] Juggling work and unpaid care. Carers UK and You Gov, 2019 [3] Living longer: caring in later working life, Office of National Statistics, March 2019

For more information on the impact of informal caring on the economy, visit https://www.helpd.co.uk/guide/home-care-vs-care-home-campaign/ We also have an infographic available via the URL above. Media ContactFor interviews, images and more information please contact Catrin Hughes on chughes@hitsearchlimited.com About HelpdHelpd is a home care agency that connects self-employed carers with those looking for flexible home care. Their mission is to give both clients and professional carers a better deal by giving them more autonomy and flexibility, both in the service they receive and the service they give. About the researchThe research has been conducted using publicly available figures from ONS, DWP, Carers UK and You Gov. The figure of £23 billion was reached by taking the tax levied on the UK’s national average yearly salary for 2018 of £29,588 and multiplying it by the number of people who are known to have left work to care for a loved one. |