What scammers do

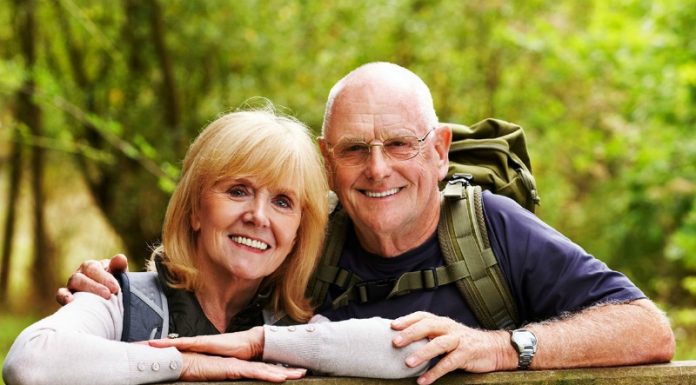

Scammers are a scourge on the modern world, preying on vulnerable members of society in order to steal their money or personal information. seniors are particularly at risk, as they tend to have more accumulated wealth and familiarity with technology than other age groups. In order to protect seniors from scammers, it is important to understand the methods they use and be aware of the warning signs that someone may be targeting you or your loved ones.

Some common tactics used by scammers include phishing emails or phone calls seeking personal information, fake charities that encourage donations or ask for sensitive data, and online schemes in which seniors unwittingly purchase overpriced goods or provide access to their bank accounts. By being aware of these scams and taking steps to stay informed about emerging threats, seniors can better protect themselves against scammers and keep their hard-earned money and valuable information safe.

What are the most common financial scams targeting seniors

Sadly, seniors are often the target of scams. This is because they are often seen as more trusting and gullible than younger people. Additionally, many seniors have a nest egg that they have saved up over their lifetime, making them an attractive target for thieves.

Some of the most common scams against seniors include , identity theft, and investment scams. In a fraud scheme, the perpetrator will attempt to gain the senior’s trust in order to convince them to hand over money or valuables. Identity theft occurs when the perpetrator steals the senior’s personal information in order to open new accounts or make changes in their name. Investment scams typically involve convincing the seniors to invest their money in a risky venture with the promise of high returns.

Often, these scams are perpetrated by someone that the senior knows and trusts, making them all the more difficult to spot. Thankfully, there are some steps that seniors can take to protect themselves from becoming victims of these types of scams. For example, they can be sure to only give out personal information to trusted individuals and organizations. Additionally, they can research any investment opportunities thoroughly before handing over any money. By taking these precautions, seniors can help to safeguard themselves against scammers.

Here is a list of some potential scams:

Automated internet scams

Automated internet scams have become a major problem in recent years, threatening the security and privacy of online users around the globe. These scams take many different forms, from phishing emails to malicious software programs that are designed to steal sensitive personal information. They often rely on automated processes to target large numbers of victims at once, making them difficult to detect and putting networks at risk of massive breaches.

Fortunately, there are several steps that can be taken to reduce the risk of falling victim to an automated internet scam. For one thing, users should always exercise caution when interacting with unfamiliar websites, especially when providing personal information. In addition, it is important for companies and organizations to invest in up-to-date security tools that can help to detect and deflect attacks from these sophisticated threats. With preventative measures like these, we can help ourselves stay safe online despite the rapid growth of these dangerous scams.

Romance scams

Romance scams are a type of online fraud, in which criminals pose as potential suitors on dating sites or social media platforms with the intention of gaining victims’ trust and extracting money from them. In most cases, the scammer will create a fake profile, using stolen photos and false information, and will reach out to potential victims with charming messages. Once they have gained their victim’s trust, they will start to ask for money, usually under the guise of needing it for travel expenses or medical bills. However, the victims never receive the money, and the scammer disappears once they have received the funds. Romance scams can be difficult to spot, as the scammers are often very convincing.

However, there are a few red flags that you can look out for, such as sudden requests for money or an unwillingness to meet in person. If you think you may be being scammed, it is important to stop all communication immediately and report the scammer to the relevant authorities.

Tech support scams

Tech support scams are becoming increasingly common, and they can be quite costly for victims. These scams generally involve a caller with a fake identity pretending to be from a tech support company. They then try to convince the victim that there is a problem with their computer and that they need to pay for a service or a fake anti virus program to fix it. In some cases, the scammer may also try to gain remote access to the victim’s computer. Once they have access, they can install malicious software or steal sensitive information.

The best way to protect yourself from these scams is to be aware of them and to never give out personal information or allow anyone to remotely access your computer. If you do receive a call from someone claiming to be from tech support, hang up and contact the company directly to verify their identity. By taking these precautions, you can help to protect yourself from becoming a victim of a tech support scam.

Lottery scams

Lottery scams are becoming increasingly common, as scammers take advantage of people’s hopes and dreams of winning big. In most cases, the scammer will contact the victim and claim to be from a legitimate lottery organization. They will then say that the victim has won a large prize, but in order to collect the money, they must first pay a small fee. In some cases, the victim may even be asked to provide personal information or bank account details. If the victim pays the fee, they will never receive their prize money, and may also find themselves at risk of identity theft.

If you are ever contacted by someone claiming that you have won a lottery, be sure to verify their identity before sending any money. You can also check with your local lottery organization to see if the name matches an authorized representative. Remember, if something sounds too good to be true, it probably is.

How you can protect your bank account from scams

As a senior citizen, you may be especially vulnerable to scams. While it’s important to stay active and engaged, you need to be aware of the potential for fraudsters to take advantage of your good nature. Here are a few things you can do to protect yourself:

Be aware of the most common types of scams targeting seniors. These include telemarketing scams, Sweepstakes/lottery scams, Medicare/health insurance scams, and identity theft.

Don’t give out personal information over the phone or online unless you are certain who you are dealing with. This includes your Social Security number, bank account information, and credit card number. They may pretend to be someone they aren’t like your personal bank, a private health insurance company, or even a company offering to do work for you.

Never wire money to someone you don’t know. Scammers often ask victims to wire money as a way to avoid being caught.

If something sounds too good to be true, it probably is. Be skeptical of offers of free gifts, easy money, or incredible deals.

If you are contacted by someone trying to scam you, hang up the phone or delete the email right away. Don’t engage with the scammer in any way. And alert your friends and family, so they can be on the lookout as well. By taking these simple steps, you can help

What to do if you’ve been scammed

If you suspect that you may have been scammed, it is important to take immediate action. First and foremost, make sure to document any evidence that could be used to support your case. This might include records of phone calls or correspondence with the scammers, as well as images of financial transactions. Next, notify law enforcement so that they can launch an official investigation.

Ultimately, regardless of the outcome of your case, it is also important to take steps to protect yourself in the future. This might mean getting a more secure email account or setting up stronger security measures for your financial accounts. By taking a proactive approach and working with others, you can help to prevent others from falling victim to the same scam in the future.

Alert your friends and family about the scam so that they can be on the lookout.

At this point, it is critical that we all work together to put an end to the scam. This means alerting our friends and family so that they can take steps to prevent themselves from being caught in the scam. Whether this involves checking the validity of requests before sending any money or searching for red flags online, we each have a role to play in stopping these scammers. So let’s band together and help each other stay safe!

Together, we can put an end to this idiotic scam once and for all.

Hang up or delete any suspicious emails or phone calls immediately.

As digital technology becomes an increasingly integral part of our lives, the risk of cybercriminals and scammers also rises. Whether through email phishing schemes or phone scams, unwanted contacts can compromise your personal data, empty your bank accounts, and even damage your reputation. Due to this, it is crucial to be vigilant when you receive any suspicious emails or phone calls.

These potential threats should be immediately identified and either hung up on or deleted. Remember that it is always better to be safe than sorry – it is better to take a moment to verify the identity of an unknown caller or sender than to mistakenly divulge sensitive information that can be used against you later on. So, if you ever encounter any unsolicited communications, do yourself a favour and hang up or delete them right away before they can do any harm.

Document any evidence of the scam

When investigating a scam, it is important to document any evidence that you encounter. This could include records of phone calls or correspondence, financial transactions, and even images of the scammers themselves. For example, you might collect screenshots of phony email messages or fraudulent websites, along with copies of receipts for money transfers or wire transfers.

Additionally, it is essential to keep track of all communications with law enforcement or other relevant agencies to ensure that any evidence you have collected is preserved properly. Overall, maintaining accurate records throughout the process will help to build a strong case against the scammers and help to protect others from falling victim in the future.

Notify law enforcement so they can investigate the matter.

If you believe you have been the victim of a scam, it is important to notify law enforcement so they can investigate. Scams can be difficult to detect, and law enforcement officials have the experience and resources to track down the people responsible. In addition, by reporting the scam, you can help law enforcement to warn others about the threat and prevent others from falling prey to the same scheme.

If you have been scammed, contact your local police department or the FBI’s Internet Crime Complaint Center at https://www.ic3.gov/. Be sure to include as much information as possible about the incident, including any correspondence you have received and any money you have lost. By taking action, you can help protect yourself and others from becoming victims of scams.

Take steps to protect yourself in the future

While no one enjoys being the victim of a scam, the experience can be especially harrowing if it results in financial losses. However, there are steps you can take to protect yourself in the future and help to prevent others from being scammed. First, review your security settings for all of your online accounts, including email and financial accounts. Strengthening your passwords and enabling two-factor authentication can go a long way toward deterring would-be scammers.

In addition, be sure to keep an eye on your credit report for any suspicious activity. If you do spot something unusual, don’t hesitate to contact your bank or financial institution immediately. Finally, if you have been the victim of a scam, consider filing a complaint with the Federal Trade Commission. By taking these steps, you can help to shield yourself from future scams and take action against those who have wronged you.

Resources for more information

When it comes to avoiding senior scams, knowledge is power. Here are some resources where you can find more information on the latest scams and how to protect yourself:

The Federal Trade Commission’s website has a section devoted to scam alerts, where you can find information on the latest senior scams as well as advice on how to avoid them. The Better Business Bureau also maintains a list of current scams, as well as tips on how to spot them. Finally, Consumers Union offers a database of consumer complaints that can help you learn about scams that have already been reported.

By keeping up-to-date on the latest senior scams, you can arm yourself with the knowledge you need to protect yourself and your finances. With a little effort, you can avoid becoming a victim of fraud.

The statistic about senior scamming

Americans over the age of 65 are estimated to lose over $2.9 billion annually to scams and other forms of financial abuse. This number is expected to grow as the population ages, and seniors are increasingly targeted by scammers.

Common scams include fraudulent telemarketing schemes, bogus prize competitions, and identity theft. While seniors can be victims of any type of scam, they are particularly vulnerable to financial abuse. This is often due to cognitive decline or social isolation, which can make it difficult for seniors to spot red flags or reach out for help.